Depending on creditworthiness, the card may have high annual fees. In addition to these potentially high yearly fees, the card comes with monthly maintenance fees starting with your second year as a cardholder. Additional authorized users, cash advance purchases, and overseas transaction fees.

These unattractive rates mean that the increase should be seen as a last resort to increase your credit.

Official Login

or

Get Assistance

Surge lets you track your credit card order and see if you pre-qualified in less than a minute. This unsecured credit card does not require collateral but comes with a significant annual fee.

Customers can register an account online at SurgeCardInfo.com or access an existing account.

How To Activate Your Surge Credit Card?

If you just got your Surge credit card from the SurgeCardInfo Login portal, you cannot use it directly. You will have to activate it first. Once you have activated your Surge card, you can log in and start enjoying its benefits.

Surge credit cards can be activated in seconds. Your card credentials are also necessary for activation, and you can easily activate your Surge Credit Card login.

You need to activate the Surge credit card first before trying to log in. Moreover, the Surge credit card activation process is online, and it only takes a few minutes. Following are the steps for Surge credit card activation:

Step 1: Go to your web browser and head over to the activation page at SurgeCardInfo. This webpage will take you to the activation page of your Surge credit card.

Step 2: You will see three credentials on that webpage. Please enter the following credentials of your Surge credit card to activate:

- Last 4 of Credit Card

- 5 Digit Zip Code

- Last 4 of SSN

The three pieces of information must be entered in their respective boxes.

Step 3: After entering your Surge credit card credentials, click “Activate My Card.“. In just a few moments, your card will be activated, and you can start using the Surge card.

SurgeCardInfo.com Login Guidelines

After registering successfully, you can log into your SurgeCardInfo account. Before logging in, make sure the credentials you created when registering are available. Follow the simple steps to log in:

Step 1: Visit the SurgeCardInfo Login page at www.surgecardinfo.com.

Step 2: Log in to SurgeCardInfo. It is the same registration portal as above.

Step 3: Please enter your username and password in the corresponding fields.

Step 4: To log into your card account, click the “Submit” button.

Registration Guidelines for Surge Mastercard

For cardholders, the registration process is straightforward. Please visit the official website at the following address: www.surgecardinfo.com.

SurgeCardInfo members must register their credit cards and set up Online Account Access before they can manage and access their cards online. Keep the card at hand and follow the steps below to begin the registration process:

Step 1: Sign in to your account at surgecardinfo.com, provided by Continental Finance.

Step 2: The “Register Now” section is located below the “Sign In” window on the page.

Step 3: Input your 16-digit SurgeCardInfo Credit Card Number into the fields provided.

Step 4: To continue, click the “Submit” button.

Surge Card Info Login Requirements

An electronic device: SurgeCardInfo requires users to have an electronic device that can access the Internet. Devices can include laptops, PCs, and mobile phones. They all have their own strengths and weaknesses. It all depends on the user. The employee can choose and access their SurgeCardInfo account using the device of their choice.

Secure Internet connection: The user must provide some personal information at SurgeCardInfo. Therefore, you should log into your registered account using a secure Internet connection. Having a fast internet connection will also help you finish this task faster.

Valid email address: The last thing to prepare before you begin is a valid email address. You will be asked to enter your email address during the login process. You need not worry about your email being shared. You will receive important information via email from SurgeCardInfo.

Benefits Accessible At SurgeCardInfo.com Login Portal

- $0 Fraud Liability: Your credit card will not be charged for any unauthorized transactions at SurgeCardInfo.

- Credit Reporting – All monthly payments are reported to the three major credit reporting agencies: TransUnion, Experian, and Equifax approved by SurgeCardInfo.

- Free Monthly Credit Score: Get free access to your Experian Vantage 3.0 score when you sign up for eStatements.

- Credit Limit Increase – Potential increase in credit limit in just six months of on-time payment.

- All types of credit are considered – applicants with different credit levels (poor, reasonable, and limited) can be considered for admission at SurgeCardInfo.

- Approval Credit Limit: A high-risk credit card will have a minimum credit limit of $300, a reasonable starting point.

- You can check your Surge account balance online, make online payments, and receive electronic statements after registering your Surge card online.

*After you’re approved for the Surge Credit Card and use it responsibly for six months, you may be eligible for a credit line increase. You can cancel your Surge Credit Card by calling the SurgeCardInfo customer service line at: 866-449-4514. You may be asked to provide some personal information like your account number and the last four digits of your social security number so that the SurgeCardInfo customer service rep can confirm your identity and ultimately process your cancellation.

List Of Other Cards Issued By Continental Finance

- Reflex card

- Fit card

- Matrix Credit Card

- Simply Gold Credit Card

| Official Name | SurgeCardInfo |

|---|---|

| Portal Type | Login |

| Mobile Application | Available |

| Language | English |

| County | USA |

How To Pay For A Surge Credit Card?

You can pay with your Surge credit card online or by calling (866) 513-4598. You can also pay by mail with your Surge credit card. In detail, the payment methods for the Surge bank card are as follows:

Pay Online: If you want to pay online, sign up for online banking at SurgeCardInfo. Additionally, you can access your bank statements online and view important information regarding your Surge credit card.

By Call: By calling (866) 513-4598, you can pay your Surge credit card bill at SurgeCardInfo. Telephone payments can be made Monday through Friday from 7:00 am to 10:00 pm ET and on Saturdays from 8:00 am to 4:00 pm ET.

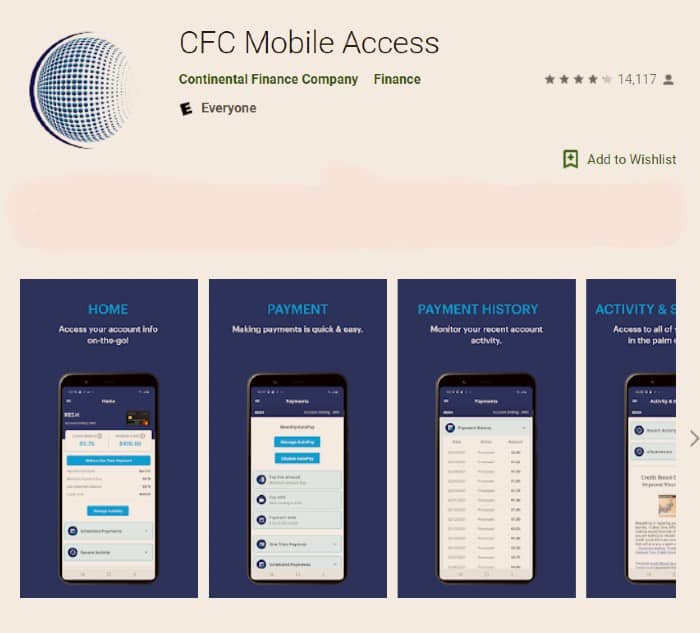

CFC Mobile Application

The Surge card from Continental Finance, which comes with its own mobile app that is available for both Android and iOS, it has same login and registration steps as the SurgeCardInfo Login page, provides the following benefits:

- View a quick overview of your account, including your credit card balance, credit remaining for the month, the next payment due date, and a helpful notification if you are over your limit or late on a payment.

- You can make a payment now or schedule one for the future.

- Recent posted and pending transactions.

- All of your past statements in one place.

- Lost/Stolen card hotline services.

CFC MobileAccess is a service offered free to cardholders of:

- The Verve Mastercard

- The Reflex Mastercard

- The Surge Mastercard

- The Fit Mastercard

- The Matrix Mastercard

- The Cerulean Mastercard

- The Build Mastercard

Frequently Asked Questions

How do I pay the extra on my credit card?

Automated account information over the phone. 1-866-449-4514. Customer service. 1-866-449-4514. Payments. 1-800-518-6142 Card lost / stolen. 1-800-556-5678.

How can I find out whether my credit card was overcharged?

To check the status of your Surge credit card order, call the issuer’s customer service department at 866-449-4514. The status of your request cannot be checked online.

What is Continental Finance’s credit card?

The Cerulean Mastercard is one of Continental Finance’s few credit cards and is issued by the Bank of Missouri.

Which bank is the Surge credit card?

Celtic Bank Surge Mastercards are designed for customers with limited or bad credit. Your payment activity is reported monthly to the three major credit reporting agencies, which can help you build credit.

Is the Cerulean credit card legitimate?

Cerulean credit card rating. Matrix card issuers have now added another card called Cerulean to their offerings. Applicants can be approved for an unsecured card or a protected version. Like the Matrix card, this offer is aimed at people with a bad credit rating.

What is a TIB credit card?

Credit Card Program TIB currently serves nearly one of five community banks in the United States and is one of the most trusted card service providers in the country. With your full-service credit card program, you can offer your customers a risk-free, turn-key credit card program.

Reset Password

You can reset your username by entering your account number, and you can reset your password by providing your username. You will need your surge credit credentials to log in to your account and access your credit card information at SurgeCardInfo Login page.tc replica watch replicadiamond face rolex replicarolex yachtmaster rose gold

Surge Credit Card Customer support

- The telephone number for customer service: 1-866-449-4514

- The telephone number for payments: 1-800-518-6142

- For lost or stolen cards: 1-800-556-5678

- Payment mailing address: Surge Card P.O. Box 31292 Tampa, FL 33631-3292

- To check the status of your Surge credit card order, call the issuer’s customer service department at 866-449-4514. The status of your request cannot be checked online.

- Automated account information over the phone. 1-866-449-4514. Customer service. 1-866-449-4514. Payments. 1-800-518-6142 Card lost / stolen. 1-800-556-5678.continentalfinance.net ›single_card_infoSurge Card – Card information | Contact and contact details continentalfinance.net ›single_card_info

Conclusion

The rapid increase in credit cards has reached the level of customer satisfaction in recent years. This is due to its easy-to-use and easy-to-use financial services. Therefore, the Surge Mastercard credit card from Surge Card Info is an excellent choice for those who need to take out a loan for the first time or improve their credit profile by using it responsibly. After registering your Surge card online, you can check your Surge account balance, make online payments, and receive electronic statements. Even though there are no rewards for purchases, it is a viable credit card option for customers who wish to build credit and gain more purchasing power.

Surge Mastercard has a high annual fee for the first year of the card and a high APR, which makes it crucial for cardholders to make payments on time each month. Given the fierce competition in the subprime credit card market, other unsecured or secured credit cards with lower fees and prices may be worth considering.